the housing market crash 2008

Low supply and high demand US. And news about an economic slowdown happening today may bring all those concerns back to the surface.

Uk House Price Crash Of Summer 2008 The Market Oracle

We havent seen interest rates this high since 2008 2007 so it is a big change from the housing market weve all gotten used to Fairweather said.

. While those feelings are understandable data can help reassure you the situation today is nothing like it was in 2008. Even if the housing market were to crash experts have cast doubt on. I hope you enjoy it.

2 days agoThe average 30-year mortgage hit a 14-year high Wednesday but that surge wont spark a crash in the US housing market akin to anything seen in 2008 investment strategist Louis Navellier told. However even as the housing market steadily. A perfect storm is brewing.

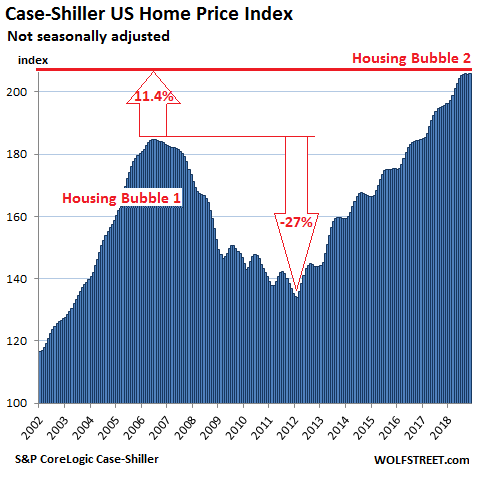

A real estate bubble is a type of economic bubble that occurs periodically in local regional national or global real estate markets. Housing Market Crash Could See Values of Homes Plummet in These 11 States When the market crashed in 2008 ARMs accounted for a much higher percentage of all active mortgages than they do now. Why this boom was different from the Housing Bubble boom.

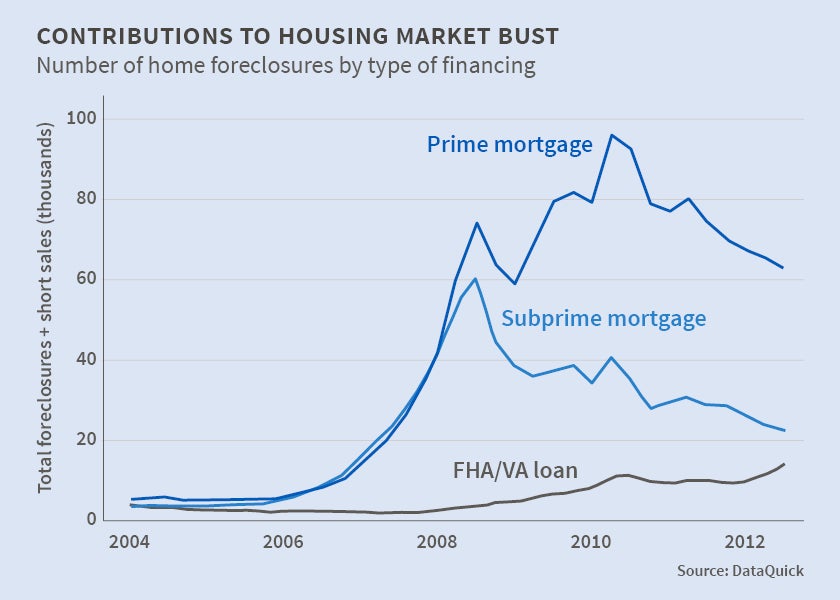

Many people remember the housing crash in 2008 but experts say todays market is fundamentally different in many ways. Plus lending standards are much tighter and homeowners have record levels of equityThat means signs say there wont be a wave of foreclosures like the last time. Many are beginning to make comparisons to the 2007 housing bubble in anticipation of a potential crash.

Heres a new 3 Minute Money on housing. By around 2013 things were inching up again. With stockshousing the FED can print and QE Inflation is motherfrrr.

From the top of the housing bubble roughly a decade ago until just recently. Home values have increased by. Housing market since the Great Depression.

Fixed rate for a 30-year mortgage rose to 589. The risk that surging rates pose. What a potential bust might look like.

When the housing market crashed in 2008 it led to an economic crisis that became known as the Great Recession. Housing market was left in a slump that lasted for years. The dynamics of the boom.

1 day agoAverage long-term US. The fundamentals are very different than back in 2008 and. The Crash.

The collapse of the housing market during the Great Recession displaced close to 10 million Americans as rising unemployment led to mass foreclosures. The data shows that interest in similar terms related to the state of the housing. Mortgage rates climbed over 6 this week for the first time since the housing crash of 2008 threatening to sideline even more homebuyers from a rapidly cooling housing market.

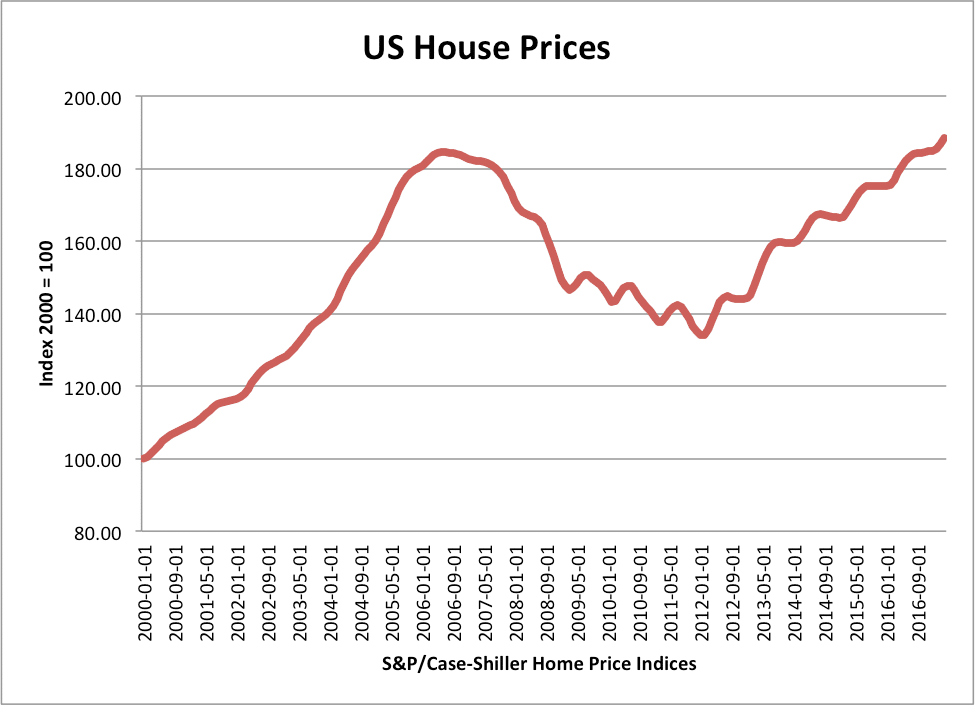

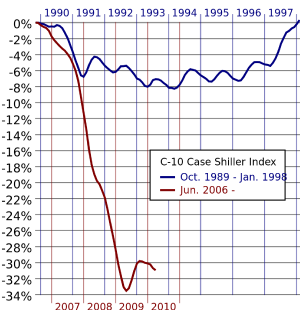

United States housing prices experienced a major market correction after the housing bubble that peaked in early 2006Prices of real estate then adjusted downwards in late 2006 causing a loss of market liquidity and subprime defaults. The US housing market is on the cusp of a deep freeze as rising mortgage rates and steep home prices conspire to limit buying and selling activity an economist warned. Whether or not you owned a home in 2008 you likely remember the housing crash that took place back then.

Homeownership can feel scary during any point of economic uncertainty especially if you have a vivid memory of the Great Recession and the housing market crash of 2008 and 2009. While the sizzling housing market has slowed down this year here is why I dont believe we will see a housing market crash like 2008. A growing number of indicators show that the housing-market slowdown is starting to look more like the 2008 crash than many originally expected William Edwards 2022-08-24T164825Z.

So is a housing market crash on the way in 2022. Last year was anything but normal especially in Arizonas real estate market. Why housing is so important to the broader economy.

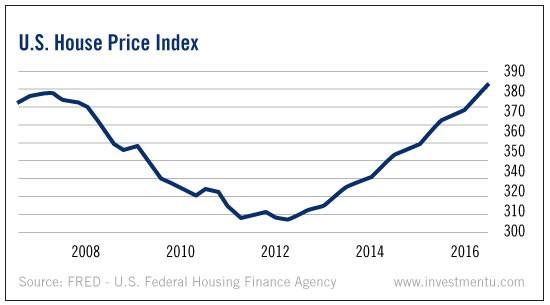

In comparison a graph from the Federal Reserve Bank of St. As the economic winds shift in a post-pandemic world and the housing market heads towards a slowdown most experts dont foresee a 2008-sized housing bust in part because of the persistently low. A senior economist says home prices are primed for a 2008-style crash as housing construction booms and demand gets crushed by rising mortgage rates William Edwards.

Home prices continue to grow even as mortgage rates soar to their highest level since 2008. The financial crisis of 2008 created the biggest disruption to the US. Mortgage rates just hit a high not seen since the housing crash of 2008 and more hikes are likely throughout the rest of 2022.

Many refer to the 2008 housing crash as a black swan due to its. Sharpest turn in the housing market since the market crash in 2008 For the first time in 17 months the average home is selling for less than its list price but high mortgage rates are. Predatory lending practices in the first years of the 21st century meant many homeowners faced foreclosure when adjustable interest rates rose and unemployment.

Rumors are making the rounds that a housing market crash could be the next black swan event that sends the economy into a spiral. This is the sharpest turn in the housing market since the housing market crash in 2008 said Daryl Fairweather Redfins Chief Economist. Even-though the US is the worlds reserve currency if Inflation is run-away the currency is destroyed.

Louis showed that housing supply shot up sharply from 2005 to 2008. In 2008 alone 31. Most people forget that run away inflation is 10X worst than a stock market crash or housing crash.

First there isnt an oversupply of homes for sale today. Following the 2008 housing crash the US. In this video I cover.

Impact Of 2008 Crash On Housing

How The Bubble Destroyed The Middle Class Marketwatch

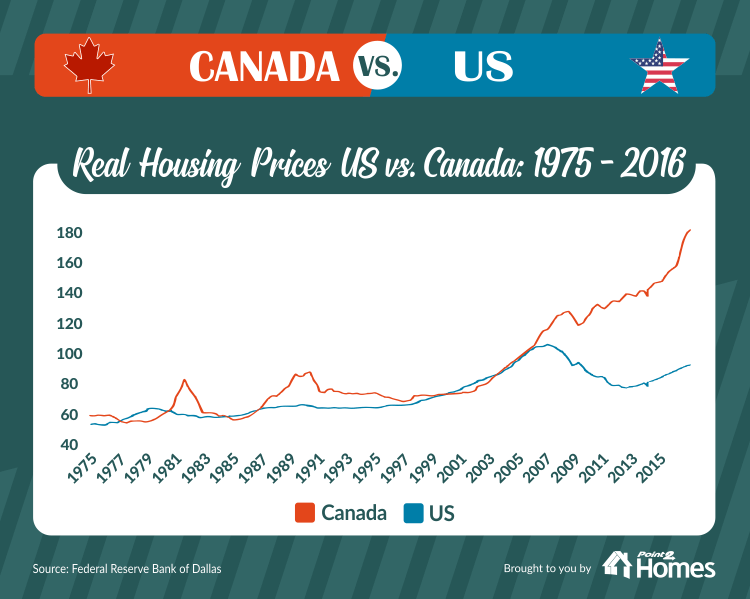

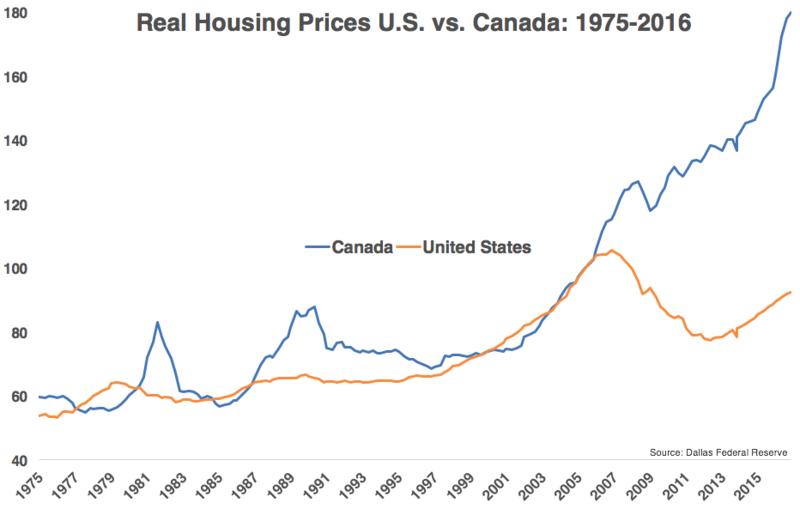

Canada Vs America Since The 2008 Recession Toronto Realty Blog

Why Did The House Prices Fall During The Global Financial Crisis Quora

The 2008 Housing Crisis Center For American Progress

Housing Market Crash Economics Help

Robert Shiller Says The Housing Market Will Crash No One Else Seems To Think So Seeking Alpha

The Risk Of Another Housing Market Crash

Why The Housing Market Is Not In A Bubble The Real Economy Blog

The Housing Bubble Is Getting Ready To Implode The Scariest Chart In Real Estate Shows An Impending Correction Because You Cana T Afford To Buy A Home Today

The 2008 Housing Crisis Center For American Progress

United States Housing Bubble New World Encyclopedia

Forget About The United States The Real Housing Bubble Is In Canada Seeking Alpha

The New Housing Bubble This Unique Chart Proves It Seeking Alpha

The U S Foreclosure Crisis Was Not Just A Subprime Event Nber

Why The Housing Bubble Tanked The Economy And The Tech Bubble Didn T Fivethirtyeight

Impact Of 2008 Crash On Housing

Why The Housing Bubble Tanked The Economy And The Tech Bubble Didn T Fivethirtyeight